The First Global Oil Shock

Posted on Monday 31 August 2020, 12:53 - updated on 28/12/20 - Energy Crisis - Permalink

- Article

- |

- Comments (0)

- |

- Attachments (0)

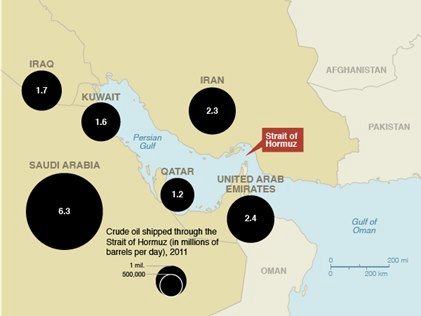

Although no specific details on the location and the nature of the occurrence of the event has been predicted, the only oil producing region where a disruption could cause such a global oil shock is the Gulf. The Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The Strait of Hormuz is the world's most important oil chokepoint because of the large volumes of oil that flow through the strait. Chokepoints are narrow channels along widely used global sea routes that are critical to global energy security. The inability of oil to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. Although most chokepoints can be circumvented by using other routes that add significantly to transit time, some chokepoints have no practical alternatives. In 2018, the daily oil flow through the Strait of Hormuz averaged 21 million barrels per day (b/d), or the equivalent of about 21% of global petroleum liquids consumption.

Although no specific details on the location and the nature of the occurrence of the event has been predicted, the only oil producing region where a disruption could cause such a global oil shock is the Gulf. The Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The Strait of Hormuz is the world's most important oil chokepoint because of the large volumes of oil that flow through the strait. Chokepoints are narrow channels along widely used global sea routes that are critical to global energy security. The inability of oil to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices. Although most chokepoints can be circumvented by using other routes that add significantly to transit time, some chokepoints have no practical alternatives. In 2018, the daily oil flow through the Strait of Hormuz averaged 21 million barrels per day (b/d), or the equivalent of about 21% of global petroleum liquids consumption.

Disruption of the port operations, oil pipelines or oil wells could cause such a shortage. The

only conceivable geophysical event which could cause such a large scale disruption in the Gulf Region is an earthquake or a tsunami or both and even a volcano or a new island. A strong earthquake in this area could damage the oil pipelines and port facilities. If the earthquake happens undersea, a Tsunami could destroy or damage some of the ports. Geophysical changes due to an earthquake could disrupt the shipping channel through the Strait of Hormuz, which is only 2 Km wide.

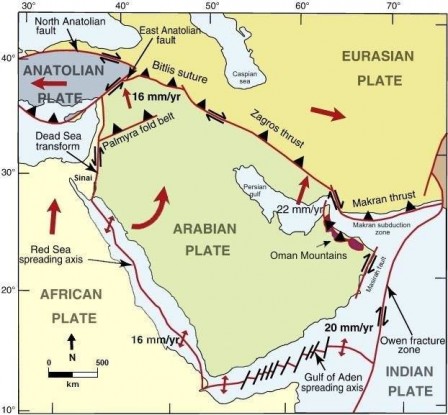

The Strait of Hormuz is very close to the Makran Subduction Zone (MSZ) where the oceanic crust of the Arabian Plate is being subducted beneath the continental crust of the Eurasian Plate at the rate of 4 cm per year. A major earthquake with a magnitude of M 8.1 took place in 1945, which generated a large tsunami in the region.

The Strait of Hormuz is very close to the Makran Subduction Zone (MSZ) where the oceanic crust of the Arabian Plate is being subducted beneath the continental crust of the Eurasian Plate at the rate of 4 cm per year. A major earthquake with a magnitude of M 8.1 took place in 1945, which generated a large tsunami in the region.

Subsequently, smaller earthquakes have taken place. On 24.09.2013 there was an earthquake with a magnitude of M 7.7 that caused ground shaking throughout the region, as well as creating an interesting feature that arose from the seafloor along the continental shelf (what this feature is called is in debate; some called it a mud volcano or an island). A shallow undersea earthquake of a large magnitude in this area could generate a tsunami which could affect the oil producing ports like Fujairah, Ras-al-Khairmah etc. near the Strait of Hormuz, even some ports in the Persian Gulf and could also damage the oil pipelines. Such a Tsunami could cause a significant damage to Pakistan’s Gwadar and Karachi Ports and even reach as far as Kandla Port in India.

Apart from that, if a volcanic island or a mud island like feature develops and blocks the Strait of Hormuz, shipping of oil may be obstructed. Studies on the earthquakes and tsunami at the MSZ can be found in the following link

Effects of the disruption of oil supply from the Gulf

The spike in oil price due to obstruction of supply from the Gulf region is well documented. However, destruction of oil facilities in this region has never happened. Uncertainty amid shortfall of crude oil and speculation arising out of such an event will cause a Global Oil Shock like we have never seen before. The worldwide speculative price increase due to fears regarding oil shortage may rapidly push the global oil price to a record high, which could touch $200 or more per barrel. The effect of the shortage and price fluctuations would be felt worldwide including in countries like India and China, which are the bulk consumers of the Gulf oil. India is heavily dependent on crude oil and LNG imports with 84% import dependence for crude oil and 45.3% for natural gas/LNG. 60% of its imports are from the Gulf Region.

Indian refiners maintain 65 days of crude storage, which is about two months worth of supplies. China maintains about three months worth of supplies. In the event of a supply disruption, the immediate effect would be rationing of petrol, diesel, LPG and ATF. Even worse would be the increase in the price of the crude, which would affect all the countries in the medium to long term.

A shortage in oil would affect many aspects of life which are not readily recognizable. Electricity prices will become costly as the price for transportation of coal rise. Travelling by cars and buses will be expensive. LPG will be unaffordable to many. Home deliveries will be costly. The aviation sector, already reeling from the effects of Corona virus will again be hit, as travelling will be costly. Tourism will be hit again. Carrying cost of essential and non-essential goods will rise. Automobile sales will plummet. Freight charges of crude oil will increase, making it costlier. Price of import of all commodities will rise enormously. The list is unending. Eventually most economies around the world will take a hit, which are already reeling from the effects of the Corona virus.

The solution

In about 5-10 years, the use of fossil fuel will not be possible due to its prohibitive cost. There will be two more global oil shocks which will bring the consumption of oil to the bare minimum. Gradually there will be a shift to a new kind of energy, the “New Electricity”, which will be (re)discovered soon.

Till then, measures to minimise the use of oil will have to be taken or rather, will be forced upon us. People will have to survive on locally procured food and local materials in small communities. Cars will be of no use and automobile industry will be decimated. Aviation and Tourism will come to a halt.

Till then, measures to minimise the use of oil will have to be taken or rather, will be forced upon us. People will have to survive on locally procured food and local materials in small communities. Cars will be of no use and automobile industry will be decimated. Aviation and Tourism will come to a halt.

As a short term measure, invest in bicycles and similar human powered modes of transport. Minimise the use of devices consuming electricity, like Air Conditioners, Washing Machines, Microwave Ovens and so on. Before the first oil shock (most likely in July-October 2020), stock 4 months worth of your essential food and medicine and replenish the stock as and when consumed. Things will go back to normal in a few months, but will soon nosedive again due to other factors. The governments would do well to purchase oil and increase their strategic oil reserve now. They should also encourage the local economy, use of bicycles and procuring materials from the local community.

Understand that Humanity and the Earth is entering in the era of The Shift. The First Global Oil Shock will be the second event of The Shift, after COVID-19. Many more will come soon. There is no need to panic but there will be a need to adjust and survive on the bare minimum. In 10 years time, the world will become unrecognizable and those of us, who survive, will be in a new (and better) world.

Edit 01.05.2020: Says #thehighersources => “Elsewhere and here, have you read of crude oil shocks, where abrupt events will cause prices to climb rapidly, shocking mankind briefly. This virus and human reactions are the first phase of events which together, shall produce the first spikes. The high amounts currently available crude oil, will not mean much in the near future. We are saying to you all, look closely at this issue as wint/summ -er peaks across Earth”.

Summer and winter peaks in the month of July in North and South Hemisphere respectively. But timing of events can’t be accurately predicted. So wait for it !

N.B. This Note was posted in my personal timeline on 30.04.2020. Re-publishing it here after #thehighersources confirmed what I guessed. They said the following on 11.07.2020:

“A rapid increase in price ―a shock― will occur when supply drops below about 75-80% of demand. Practical example, your vehicle holds 60 liters but you can only get 45. What happens if you run low, your job is critical and you NEED to drive that vehicle (e.g. you're a nurse or fire fighter) but can't locate more fuel? Somebody selling it will make it available, highest bidder wins. A commercial vehicle hauling refrigerated food must reach its destination by deadline, and will pay more just as will the medical or public safety folks. The cause would be s simple seismic event which closes the Strait of Hormuz, a bottleneck or choke point for world crude oil supply. About one fifth of crude oil production passes through every day; it's only about 35km wide at the most narrow point. One bad earthquake would be a bonanza for oil pipeline construction!”

Oil pipeline will be constructed on an urgent basis to transport oil so that the block in the Strait of Hormuz can be bypassed This will take about 4 months